Nassim Nicholas Taleb teases his upcoming book ‘The Lydian Stone,’ set for a 2025 release.

Category: Twitter

[Twitter] Nassim Taleb announces female scholarships open for virtual #RWRI 19 (Real World Risk Workshop) 2024

“Friends, we have female scholarships (up to 99.999999999%) open for this summer’s virtual #RWRI 19…” Taleb tweeted.

[Twitter] Mega 3-hour podcast episode on Nassim Nicholas Taleb’s The Black Swan

[New Version] Informational Rescaling of PCA Maps with Application to Genetic Distance

A new version of the paper using entropy-based Principal Components maps for genetic distance (vs Gaussin correlation-based methods). Applied to the PCA of the entire world population, relative distances are markedly different!

Link to the paper – https://arxiv.org/pdf/2303.12654.pdf

[Twitter] Nassim Taleb’s interview with Tucker Carlson when Skin in the Game came out

with Tucker Carlson when Skin in the Game (SITG) came out: Imagine fewer bureaucrats with no SITG, no CIA, a noninterventionist State Dept… In SITG I said that sending State Dept employees to the beach would be better for America & much better for the world.

YouTube video of the interview

You can get the book (Skin in the Game: Hidden Asymmetries in Daily Life) here: Paperback or Hardcover

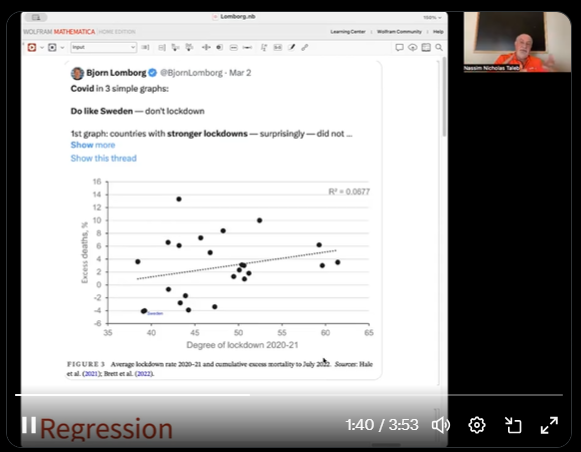

[Twitter] A mini tutorial explaining the #FooledbyRandomness point

Mistakes often made in the interpretation of R^2 beyond the standard textbook by people who haven’t studied the ‘Fooled by Randomness’ effect on parameters of distribution, particularly when samples are small.

Nassim Taleb announces #RWRI (Real World Risk Workshop) 2024

Workshop organized by the Real World Risk Institute. The workshop is an intense 10-day online program, and the 19th edition will take place from Jun 25- Jul 5, 2024.

[Twitter] Explaining the debt/death spiral

Errata: 30 Trillion not Billions.

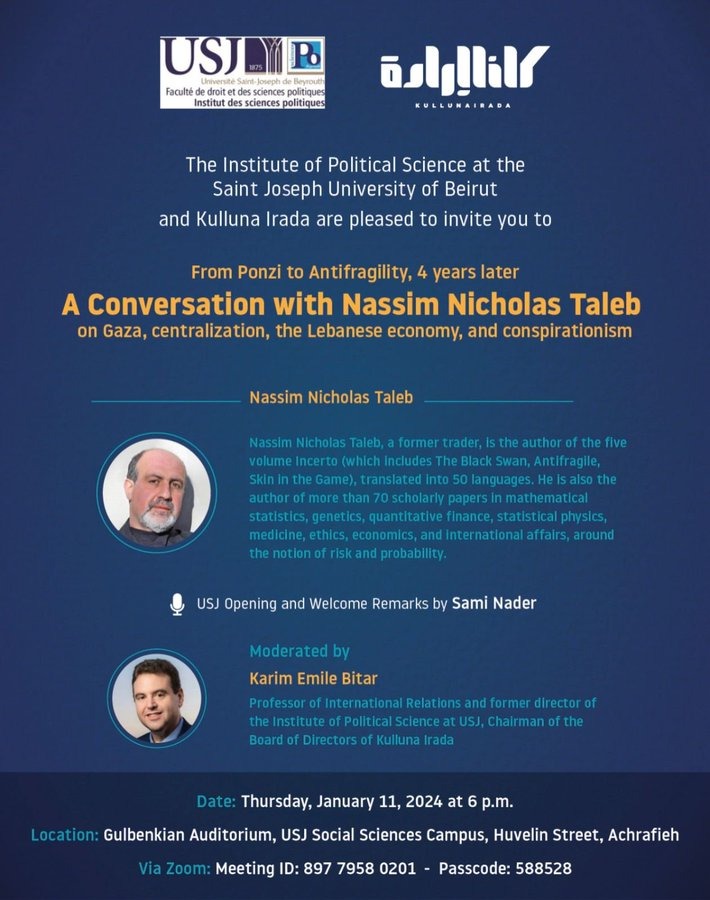

[Upcoming] A Conversation with Nassim Nicholas Taleb (2024)

Event Invitation: A Conversation with Nassim Nicholas Taleb

Hosted by: The Institute of Political Science at the Saint Joseph University of Beirut and Kulluna Irada

Event Title: From Ponzi to Antifragility, 4 Years Later

Featuring: Nassim Nicholas Taleb

Topics: Gaza, Centralization, the Lebanese Economy, and Conspirationism

Moderator: Karim Emile Bitar

Date and Time: Thursday, January 11, 2024, at 6 PM

Location: Gulbenkian Auditorium, USJ Social Sciences Campus, Huvelin Street, Achrafieh

Virtual Attendance via Zoom:

- Meeting ID: 897 7958 0201

- Passcode: 588528

Join us for an insightful evening with Nassim Nicholas Taleb, discussing critical contemporary issues in a conversation moderated by Karim Emile Bitar.

[Twitter] Scott Patterson and Nassim Nicholas Taleb on Chaos Kings, Black Swans and the Precautionary Principle

On CNBC’s ‘The Exchange’, host Kelly Evans engages in a discussion with Scott Patterson and Nassim Nicholas Taleb on how Wall Street traders made billions by making big bets around major catastrophes.