Explaining the debt/death spiral. Some of my comments were spreading on social media (they was a a discussion in Congress).

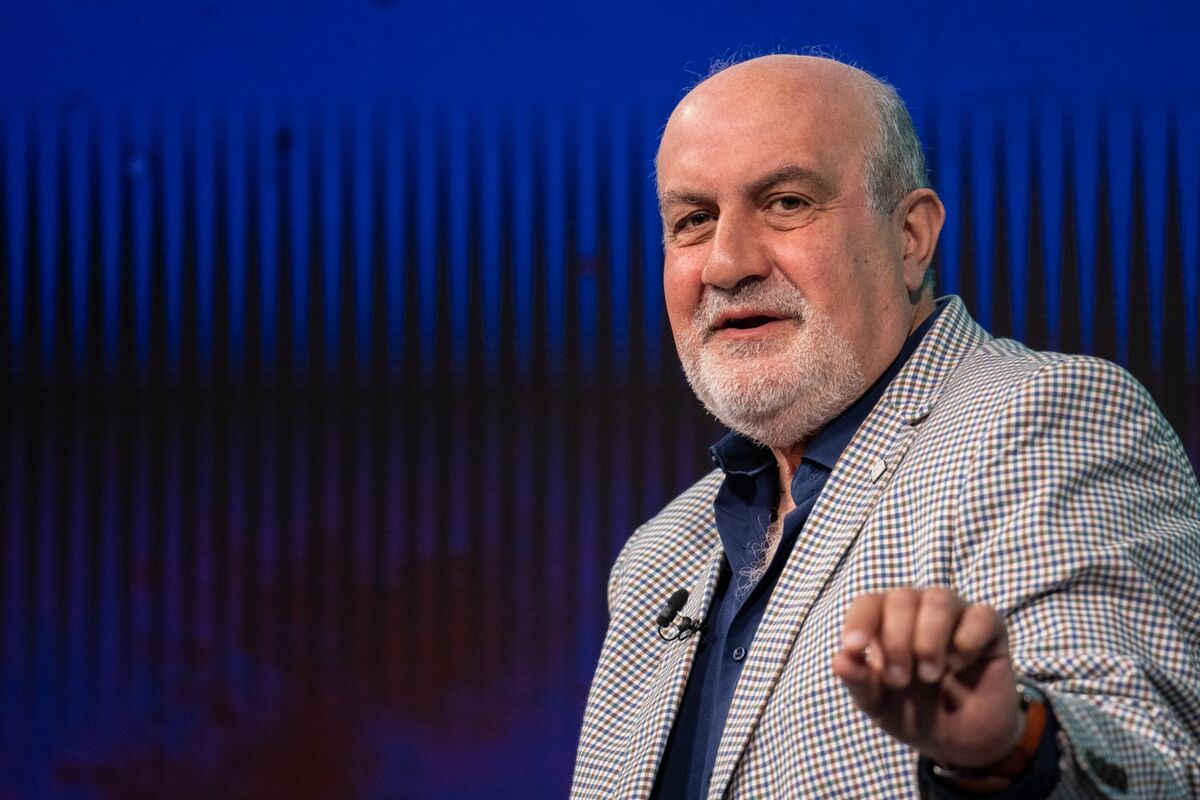

— Nassim Nicholas Taleb (@nntaleb) February 1, 2024

Debt servicing = 40% of the past deficit. Next year we will pay interest on that. Debt servicing will reach 70% ,80%, displacing other expenditures.

On… pic.twitter.com/gsbiiVm5p3

Errata: 30 Trillion not Billions.