I cannot live in societies that spend trillions on nuclear weapons yet are incapable of delivering COVID testing to their populations.

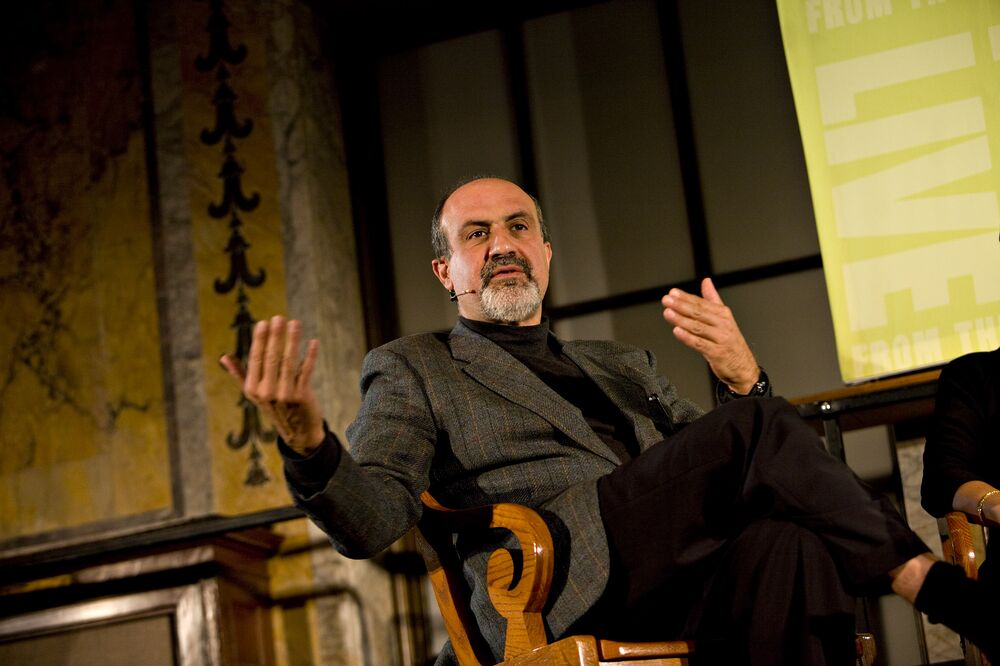

— Nassim Nicholas Taleb (@nntaleb) May 24, 2020

The world's pseudosophistication & misallocation of resources have been increasing… pic.twitter.com/9hBjwnRbqg

Category: Twitter

Bloomberg: Black Swan Author Spars With Quant Legend Over Tail Risk Hedges

“Black Swan” author Nassim Nicholas Taleb and quant investing pioneer Cliff Asness have engaged in a vitriolic Twitter dispute over the esoteric world of tail-risk hedging that descended into personal insults.

The spat began when Taleb sent a pair of tweets accusing the $143 billion AQR Capital Management LLC of issuing flawed reports that say tail-risk hedging doesn’t work.

Link to Bloomberg article: Black Swan Author Spars With Quant Legend Over Tail Risk Hedges

The only man who has a clue about the Coronavirus Pandemic

Link to original article – Taleb: The Only Man Who Has A Clue

Note: If viewing this as an email please click through to the post to view content.

Uncertainty, Certainty and what to do when there is Systemic Risk

Third conversation between Nassim Nicholas Taleb & Yaneer Bar-Yam about uncertainty, certainty and what to do when there is a systemic risk; what not to do when a truck is headed your way. How acting early would have cost less? They also discuss:

- John Ioannidis recent post “we are making decisions without reliable data”

- Why we should make decisions without reliable data & use precautionary principles

- How the costs would be so much smaller if we would have acted earlier.

Jan 26 Coronavirus Paper (PDF) – Joseph Norman, Yaneer Bar-Yam, and Nassim Nicholas Taleb, Systemic risk of pandemic via novel pathogens – Coronavirus: A note, New England Complex Systems Institute (January 26, 2020).

Note: If viewing this as an email please click through to the post to view content.

How long will the Coronavirus shutdown take?

Note: If viewing this as an email please click through to the post to view content.

Nassim explains the Kelly criterion

Nassim explains the Kelly criterion and illustrates why “risk aversion” in Behavioral Finance is Micky Mouse(™) Science.

Note: If viewing this as an email please click through to the post to view content.

Transcription of Nassim’s lecture at Academy of Sciences Leopoldina on how RISK & PARANOIA are misunderstood by psychologists & BS vendors

Note: If viewing this as an email please click through to the post to view content.

Nassim tweets How to react to Pandemics

Download Link – https://www.academia.edu/41743064/Systemic…

Nassim Taleb keynoting the launch of the Makridakis Open Forecasting Center on January 21st at University of Nicosia

Reservation Link – https://mofc.unic.ac.cy/mofc-2020-rsvp/

What to expect from the 2020s: the world’s big thinkers make their predictions

Link to full article: Thetimes.co.uk