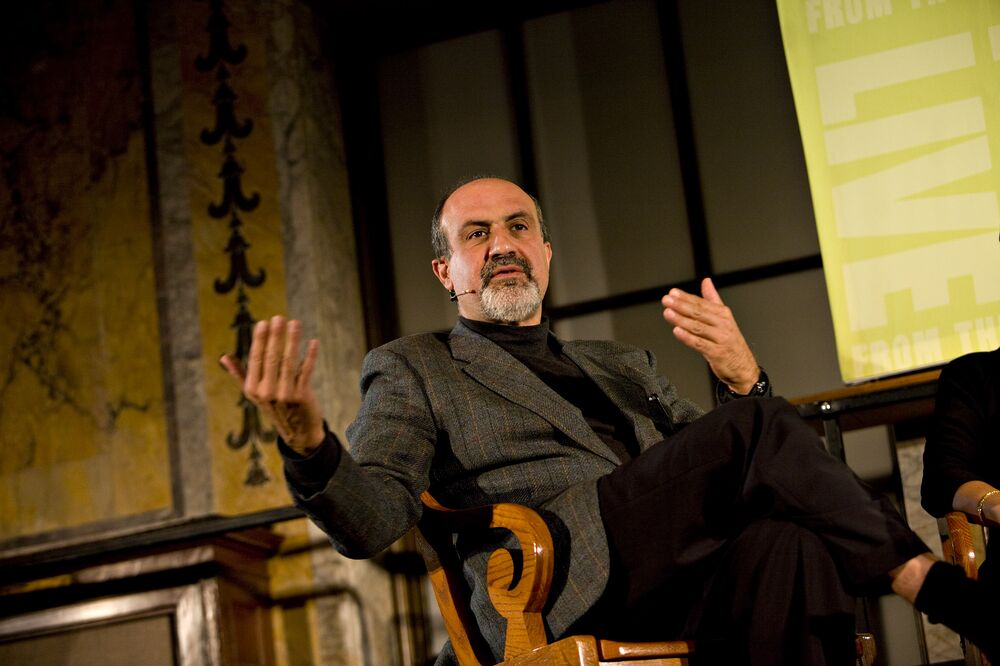

Pasquale Cirillo & Nassim Nicholas Taleb

The COVID-19 pandemic has been a sobering reminder of the extensive damage brought about by epidemics, phenomena that play a vivid role in our collective memory, and that have long been identified as significant sources of risk for humanity. The use of increasingly sophisticated mathematical and computational models for the spreading and the implications of epidemics should, in principle, provide policy- and decision-makers with a greater situational awareness regarding their potential risk. Yet most of those models ignore the tail risk of contagious diseases, use point forecasts, and the reliability of their parameters is rarely questioned and incorporated in the projections. We argue that a natural and empirically correct framework for assessing (and managing) the real risk of pandemics is provided by extreme value theory (EVT), an approach that has historically been developed to treat phenomena in which extremes (maxima or minima) and not averages play the role of the protagonist, being the fundamental source of risk. By analysing data for pandemic outbreaks spanning over the past 2500 years, we show that the related distribution of fatalities is strongly fat-tailed, suggesting a tail risk that is unfortunately largely ignored in common epidemiological models. We use a dual distribution method, combined with EVT, to extract information from the data that is not immediately available to inspection. To check the robustness of our conclusions, we stress our data to account for the imprecision in historical reporting. We argue that our findings have significant implications, including on the extent to which compartmental epidemiological models and similar approaches can be relied upon for making policy decisions.

Link to the Paper – Tail risk of contagious diseases