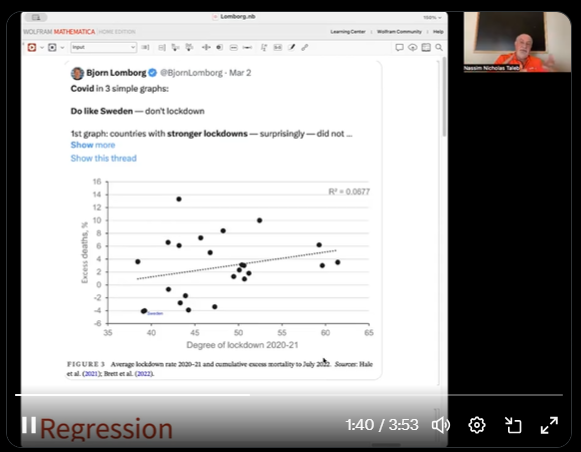

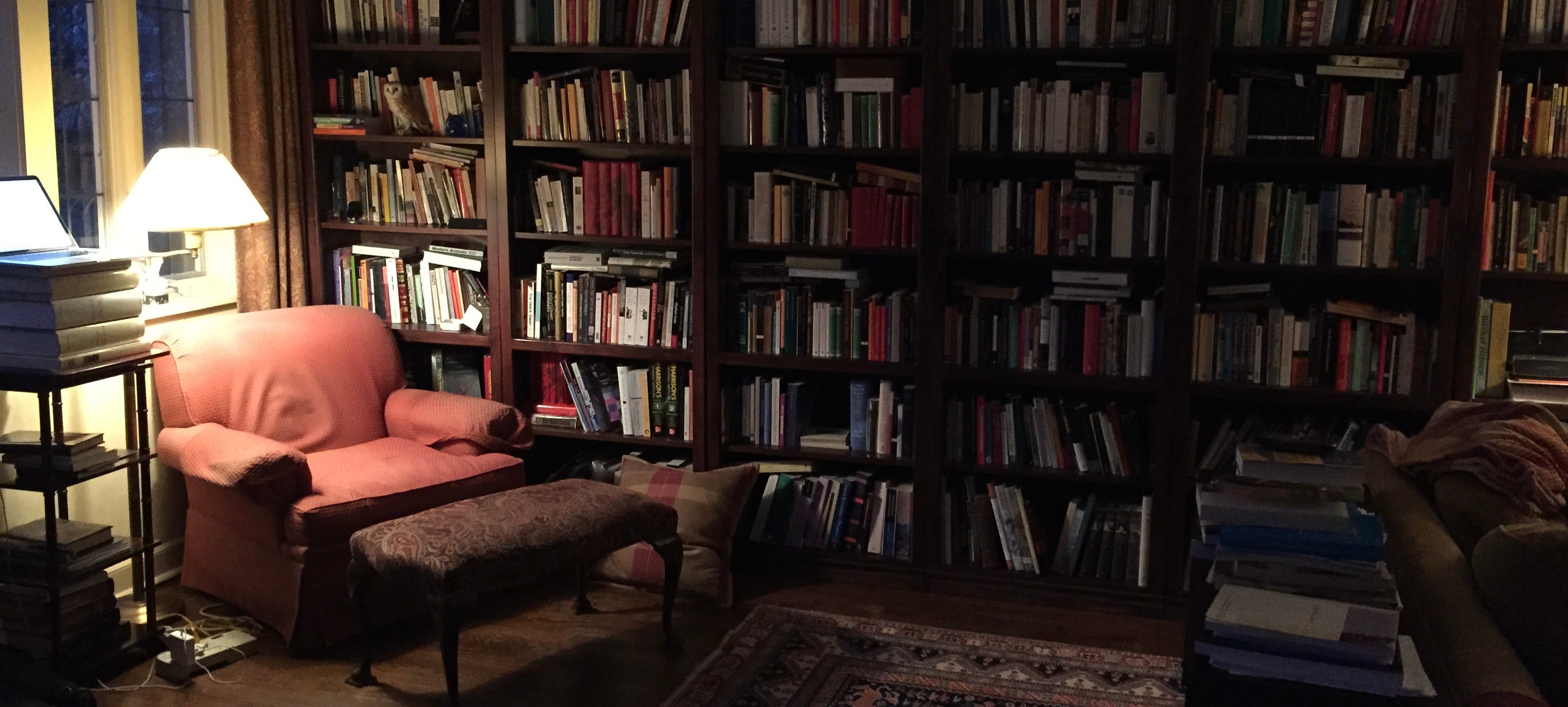

Mistakes often made in the interpretation of R^2 beyond the standard textbook by people who haven’t studied the ‘Fooled by Randomness’ effect on parameters of distribution, particularly when samples are small.

.org (UNOFFICIAL news site)

Mistakes often made in the interpretation of R^2 beyond the standard textbook by people who haven’t studied the ‘Fooled by Randomness’ effect on parameters of distribution, particularly when samples are small.

Nassim Nicholas Taleb joined Eric Hacopian of CivilNet for a discussion on science, artificial intelligence, and ongoing societal advancements. Gain valuable insights into the workings of the social fabric in this engaging conversation with Nassim Nicholas Taleb.

As a scientific advisor for Universa Investments and author of ‘The Black Swan’, Nassim Taleb recently appeared on ‘Squawk Box’ to discuss the current state of the markets and economy. During the interview, he expressed his concerns about a potential bubble looming in the near future. Additionally, he shared his thoughts on the impact of cryptocurrency on the economy. Overall, Taleb provided valuable insights into the current economic landscape and potential risks that investors should be aware of.

Full Interview Link: Available to CNBC Pro Subscribers – Watch CNBC’s full interview with ‘The Black Swan’ author Nassim Taleb

On CNBC’s ‘The Exchange’, host Kelly Evans engages in a discussion with Scott Patterson and Nassim Nicholas Taleb on how Wall Street traders made billions by making big bets around major catastrophes.

In this discussion, Nassim Nicholas Taleb, a renowned scholar and risk analyst, was interviewed by Tom Keene at the Bloomberg Invest New York 2023 event. Taleb discussed a variety of pressing financial matters, including Bitcoin and cryptocurrencies, central bank interest rates, and the future of finance.

Taleb argued that Bitcoin and cryptocurrencies are inefficient for transactions, are losing their appeal to illegal actors, and are vulnerable to be replaced by federal digital currencies. He also warned about the dangerous complacency and misunderstanding of risk in the financial world, citing the unexpected collapse of Swiss banks and the rapid rise in inflation that caught central banks off guard. He argued that central banks should gradually adjust interest rates and should not be seen as the ultimate solution to economic problems. Finally, Taleb discussed the future of finance, predicting higher and more stable interest rates that are more in line with historical norms, and emphasizing the importance of caution in the face of unpredictable market events.

Universa Investments Senior Scientific Advisor Nassim Taleb says the stock market is way too overvalued given current interest rates, and the road back to normal will be “very painful for some.” Taleb spoke exclusively to Bloomberg’s Sonali Basak at an investor day in Miami on Thursday. Earlier, Universa Investments told clients that ballooning debts across the global economy are poised to wreak havoc on markets rivaling the Great Depression.

On The Cluster of Charlatans, Zero Interest Rate Virgins, & Crypto Tumors

Interview with Laeticia Strauch-Bonart in L’Express (French magazine), translated.Last year, 2022 was not of much respite for cryptocurrencies. While bitcoin has lost more than 60% of its value, the entire sector is in crisis, punctuated by various bankruptcies such as those of Terra and FTX. The phenomenon is the consequence, according to scholar and former trader Nassim Nicholas Taleb, of the low-interest rate “Disneyland” economy in which we have been living for fifteen years. A “cluster” was formed: Pro-putin, climate and Covid deniers, carnivores, and crypto culties, that Taleb, a former crypto hopeful but a fierce opponent since 2021, has decided to attack head-on.

Continue reading on Medium: medium.com/incerto/bitcoin-is-the-detector-of-imbeciles-e5cc5eeccdbf

Ms Nina Ticholz backed up her saturated fat propaganda with a major paper showing that saturated fats don’t cause cardiovascular disease that was “ignored by mainstream media”. It turns out the paper shows the opposite of what she claims. I show how to read risk ratios, confidence intervals, etc.

(Preface to the 15th year Italian edition of The Black Swan)

Imet Luca Formenton, Saggiatore’s capo twenty years ago, in April 2002, in the eternal city, in a mozzarella bar-terrace near the parliament. I spoke in highly ungrammatical Italian; he addressed me in impeccable English, a practice we have sort of maintained for twenty years. That was the period when I very badly wanted to satisfy my failed childhood dream to produce literature, but everything conspired to stop me from partaking of that highly protected genus.

Continue reading on Medium: medium.com/incerto/how-i-write-8b495eae0330

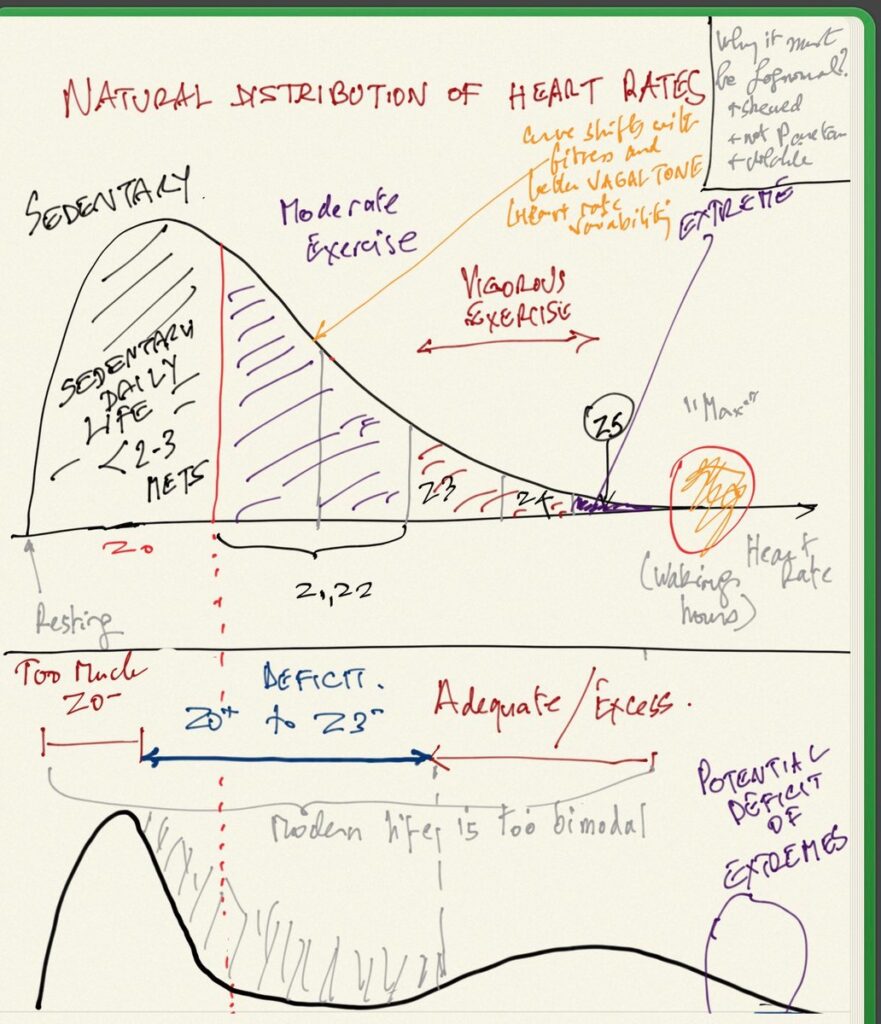

Heart rates must be Lognormal in distribution. Simply, it is not possible to have a negative heart rate and at low variance (and a mean > 6 standard deviations away from 0), the lognormal behaves like a normal.

Incidentally I failed to understand from San-Millan’s paper(s) the 2 mmol lactate threshold claimed in the podcast with Petter Attia and elsewhere. I don’t see a threshold. Even for athletes (top graph below) there is a mix outside asymptote (Lactate >5 mmol becomes 0 fat oxidation).

Link to full article – https://fooledbyrandomness.com/blog/2022/10/16/this-overhyped-zone-2-training-must-not-be-discrete/