Technical Appendix to the paper on violence: What do you do when the data looks like it is power law distributed over a broad range, but cannot be technically a power law? We use dual distribution and transport parameters between one and another.

Author: Arn

[YouTube] Claims that Violence Has Dropped Are Not Statistical

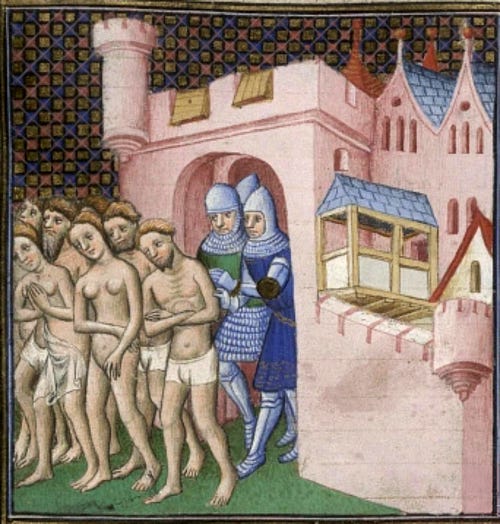

Violence is from Extremistan, hence requires some more sophisticated tools since LLN works slowly. We see how Pinker’s thesis is bogus. We look at ways to integrate the factual unreliability of historical accounts. We look at transformations to analyze violence using Power law tools since the worst case is bounded at the contemporary population level.

Links to Papers with Pasquale Cirillo

On the statistical properties and tail risk of violent conflicts [TECHNICAL, PHYSICA A]

The Decline of Violent Conflicts: What Do the Data Really Say? [NONTECHNICAL, NOBEL FOUNDATION]

[Medium] Religion, Violence, Tolerance & Progress: Nothing to do with Theology

If you think you will change the behavior of religious people by modifying the theologies, you are committing the standard Weberian fallacy. It is not about the religion; it is about clusters of people who happen to have that religion and their culture.

Continue reading on Medium: medium.com/incerto/religion-violence-tolerance-progress-nothing-to-do-with-theology

Paper: On single point forecasts for fat-tailed variables

Abstract

We discuss common errors and fallacies when using naive “evidence based” empiricism and point forecasts for fat-tailed variables, as well as the insufficiency of using naive first-order scientific methods for tail risk management.

We use the COVID-19 pandemic as the background for the discussion and as an example of a phenomenon characterized by a multiplicative nature, and what mitigating policies must result from the statistical properties and associated risks. In doing so, we also respond to the points raised by Ioannidis et al. (2020).

Link to Paper – sciencedirect.com/science/article/pii/…

How to Price an Election: A Martingale Approach

Discussion with Dhruv Madeka of the paper: Election Pricing: a Martingale Approach and other related works.

Link to the Paper: Election Predictions as Martingales: An Arbitrage Approach

Nassim Taleb speaking at Business Insider Global Trends Festival 2020

From the website:

Nassim Nicholas Taleb is an American economist, philosopher and trader of Lebanese origin. In his academic work, he focuses on issues connected with probability, randomness and uncertainty. He is a professor at the University of New York and author of bestsellers: “The Black Swan. The Impact of Highly Improbable”, and “Antifragile. Things That Gain From Disorder”. The Sunday Times has chosen “The Black Swan” as one of the 12 most important books published after World War II.

Date: 19th – 23rd October 2020

9 hours of live streaming every day

Streaming link and access code will be given within 24-48 hours before the showtime.

For tickets go to in.bookmyshow.com

Fake Regression by Psychologists

Fake Regression by Psychologists (Fooled by Randomness), Based on the paper on Trust by Nicolas Baumard

How to detect fake regressions. Never pay attention to numbers before looking at the graph.

First I show how to spot fakes in a sinister paper by Nicolas Baumard et. al. linking people’s physical traits to (un)trusworthiness.

Second, more technically, I derive the distribution of the slope between two random variables and show how one can game it.

[PODCAST] SophieCo Visionaries with Sophie Shevardnadze: Nassim on Covid-19 bringing socialism to America

The Covid-19 pandemic came as an external shock, almost unprecedented. How can we navigate the uncertainty of the post-pandemic future? We talked to the author of bestselling books ‘The Black Swan’, ‘Antifragile’, and ‘Skin in the Game’, risk analyst Nassim Nicholas Taleb.

SophieCo Visionaries is an Interview show on RT hosted by Sophie Shevardnadze where she talks to people who look beyond today and see the bigger picture.

Link to Podcast – soundcloud.com/rttv/sophieco-visionaries-nassim-taleb…

Link to Transcript – rt.com/shows/sophieco-visionaries/497321-taleb…

[PODCAST] EconTalk with Russ Roberts: Nassim on the Pandemic

Nassim Nicholas Taleb talks about the pandemic with EconTalk host Russ Roberts. Topics discussed include how to handle the rest of this pandemic and the next one, the power of the mask, geronticide, and soul in the game.

Link to Podcast – econtalk.org/nassim-nicholas-taleb-on-the-pandemic/

Direct Link (mp3): Talebpandemic.mp3

[Medium] Lebanon: from Ponzi to Antifragility

About two years before the recent collapse, at a dinner, a then (slow thinking) member of the Lebanese parliament kept bugging me for an economic forecast. There was already some anxiety in the air. My answer was that we were facing imminent financial disaster, but that it was not necessarily bad news, long term. Why? Because such a total collapse could lead to natural responses that are better than the one we would have spontaneously, going from patching bad stuff to patching worse stuff. The lira was artificially kept too strong for any industry to survive and the financial system (the Ponzi) was sucking up all the money and destroying the economic substructure. But my point was that the (unavoidable) collapse would lead to an adaptation, the weaning from chronic foreign “loans” and, possibly, a huge bounce. De-financializing the country was a necessity, and people never do that spontaneously. Nothing was going to be fixed without a collapse. Was I optimistic? pessimistic? He was trying to figure out what I was saying and couldn’t get it as it did not fit his elementary static classification.

Continue reading on Medium: medium.com/@nntaleb/lebanon-from-ponzi-to-antifragility