Nassim shares Chapter 1 of his work-in-progress, Silent Risk, which explains what the Black Swan problem is and is not. He comments that it is “still incomplete, but useful.”

From his Facebook Page.

.org (UNOFFICIAL news site)

Nassim shares Chapter 1 of his work-in-progress, Silent Risk, which explains what the Black Swan problem is and is not. He comments that it is “still incomplete, but useful.”

From his Facebook Page.

Knowledge@Wharton: Nassim Taleb on Living with Black Swans

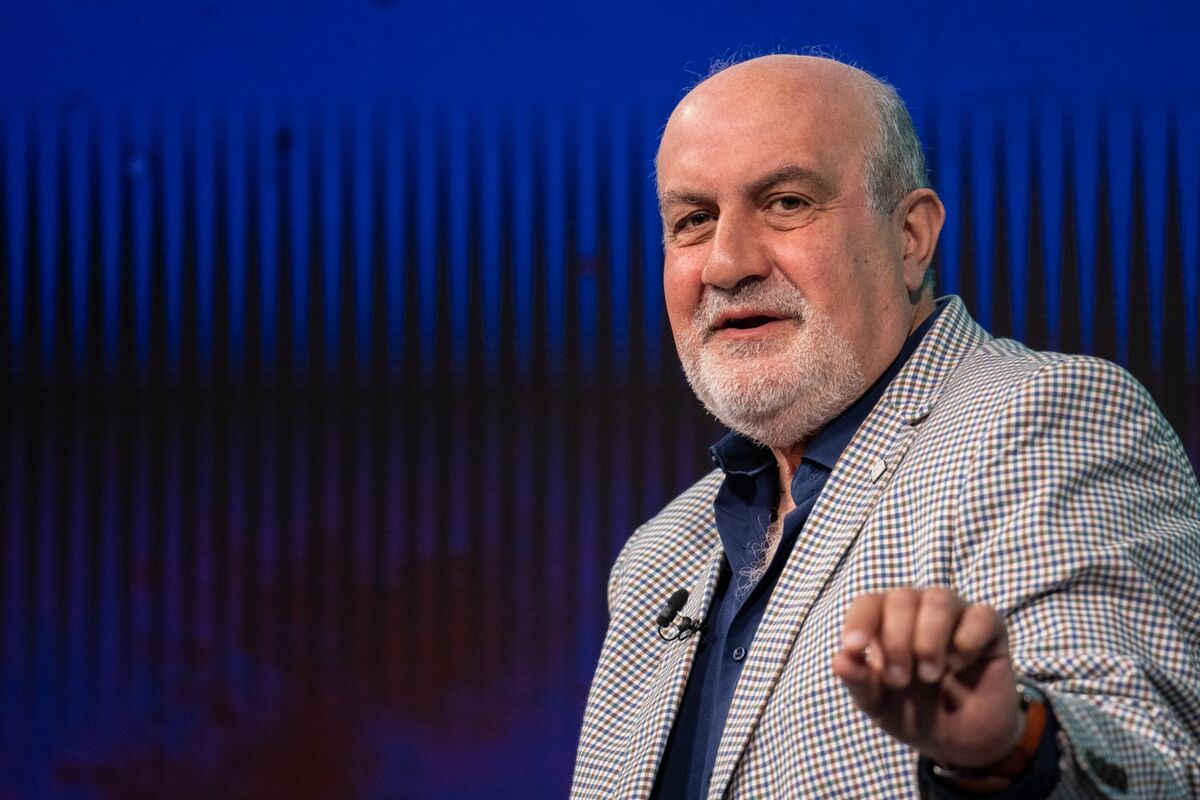

Nassim Taleb is a literary essayist, hedge fund manager, derivatives trader and professor of risk engineering at The Polytechnic Institute of New York University. But he is best known these days as the author of The Black Swan: The Impact of the Highly Improbable. During a recent visit to Wharton as part of The Goldstone Forum, he spoke with Wharton finance professor Richard Herring — who taught Taleb when he was a Wharton MBA student — about events in the Middle East, the oil supply, investing in options, the U.S. economy, the dollar, health care and of course, black swans.

Nassim Taleb talks to Consuelo Mack on WealthTrack about risk, bias, and the role of Black Swans in influencing history, investing, and more.

Paul Solman explains “hedge funds” and why “Black Swan” events make it harder than might be expected to reduce investment risk (October, 2006).

Transcript:

“Nassim: The difference between Hedge Funds, and Mutual Funds, is that Mutual Funds take your money and they have a lot of constraints on what they can do for you. A Hedge Fund has usually more freedom, to invest, to make bets, to gamble, to do whatever you want.

Paul: OK lets take it back to 2000, I have a lot of finance professor friends, so of whom would presumably go on my board. People know me on television as a financial somethingerather. Do you think I could have actually started a Hedge Fund?

Nassim: You would have billions under management currently.

Paul: I would have billions??

Nassim: Yes, because all you would had to do was go to university and pickup a couple professors ok, hire a couple risk managers–usually they have a foreign accent, you know they’re quants…

Paul: Quants??

Nassim: Quants, like me, my background is a quant.

Paul: [to the camera] Quants, as in quantitative types, so called financial engineers like Taleb, himself a mathematician, a Hedge Fund owner, and author of a steeply sceptical book on investing called Fooled by Randomness.

Nassim: All you had to do is provide these steady returns, or, the illusion of low-risk returns.”

Oct.16 — The Black Monday crash was 30 years ago this week. “Black Swan” author Nassim Taleb was a trader for First Boston at the time. He made a lot of money while others lost fortunes. He recounts the experience with Bloomberg’s Erik Schatzker.

Also see written article here: The Crash of ’87, From the Wall Street Players Who Lived It

Black Swan author Nassim Nicholas Taleb said the US deficit is swelling to a point that it would take a miracle to reverse the damage.

Read More… [https://www.bloomberg.com/news/articles/2024-01-30/nassim-taleb-says-us-faces-a-death-spiral-of-swelling-debt]

As a scientific advisor for Universa Investments and author of ‘The Black Swan’, Nassim Taleb recently appeared on ‘Squawk Box’ to discuss the current state of the markets and economy. During the interview, he expressed his concerns about a potential bubble looming in the near future. Additionally, he shared his thoughts on the impact of cryptocurrency on the economy. Overall, Taleb provided valuable insights into the current economic landscape and potential risks that investors should be aware of.

Full Interview Link: Available to CNBC Pro Subscribers – Watch CNBC’s full interview with ‘The Black Swan’ author Nassim Taleb

In this Bloomberg Odd Lots podcast episode, hosts Joe Weisenthal and Tracy Alloway have a wide-ranging conversation with Nassim Taleb, well-known author of Antifragile, The Black Swan, and Fooled by Randomness. Taleb has been engaging in public debates on Twitter with various communities such as Bitcoiners, anti-vaxxers, venture capitalists, and deadlifters. The discussion covers topics such as Taleb’s clash with these communities and what they’re getting wrong about his ideas, as well as his newfound passion for cycling and how to reduce tail risk in one’s own life. Join us for this engaging conversation on finance, economics, and markets.

(Preface to the 15th year Italian edition of The Black Swan)

Imet Luca Formenton, Saggiatore’s capo twenty years ago, in April 2002, in the eternal city, in a mozzarella bar-terrace near the parliament. I spoke in highly ungrammatical Italian; he addressed me in impeccable English, a practice we have sort of maintained for twenty years. That was the period when I very badly wanted to satisfy my failed childhood dream to produce literature, but everything conspired to stop me from partaking of that highly protected genus.

Continue reading on Medium: medium.com/incerto/how-i-write-8b495eae0330

At the 2022 Greenwich Economic Forum-Miami, Black Swan author, Nassim Nicholas Taleb explains why correlation is unreliable as a due diligence tool. Coming as it does during an ongoing pandemic and in the middle of Vladimir Putin’s invasion of Ukraine, Taleb also discusses Wars and Pandemics and puts them into their proper risk buckets.