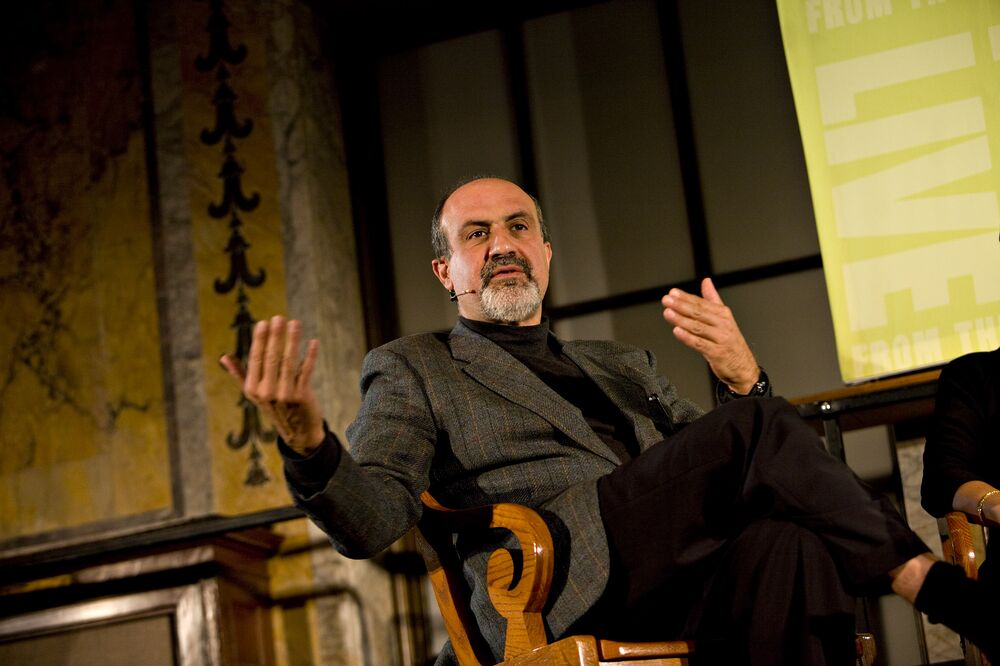

“Black Swan” author Nassim Nicholas Taleb and quant investing pioneer Cliff Asness have engaged in a vitriolic Twitter dispute over the esoteric world of tail-risk hedging that descended into personal insults.

The spat began when Taleb sent a pair of tweets accusing the $143 billion AQR Capital Management LLC of issuing flawed reports that say tail-risk hedging doesn’t work.

Link to Bloomberg article: Black Swan Author Spars With Quant Legend Over Tail Risk Hedges