Nassim Nicholas Taleb teases his upcoming book ‘The Lydian Stone,’ set for a 2025 release.

[Twitter] Nassim Taleb announces female scholarships open for virtual #RWRI 19 (Real World Risk Workshop) 2024

“Friends, we have female scholarships (up to 99.999999999%) open for this summer’s virtual #RWRI 19…” Taleb tweeted.

[Twitter] Mega 3-hour podcast episode on Nassim Nicholas Taleb’s The Black Swan

[YouTube] MINI LECTURE 18 (MORE TECHNICAL): How to build a positive definite correlation matrix for Monte Carlo Simulations for a set dimensionality

How to build by tinkering with a positive definite correlation matrix for Monte Carlo simulations for a given dimensionality.

[YouTube] MINI LECTURE 17: Maximum Ignorance Probability (a bit more technical)

What do you do when you must estimate a probability and there is ZERO information? A surgeon did 60 operations with 0 failure. What’s her or his failure rate? I didn’t realize that the trick wasn’t in the literature until John Hughes wrote a paper in Statistics and Probability Letters based on my blog post presenting the idea.

[YouTube] MINI LECTURE 16: On the Absurdity of Standard Genetics Reports

Why reports from genetic firms saying you are 30% Greek, 15% Sicilian, and 5% Martian are complete misrepresentations?

[New Version] Informational Rescaling of PCA Maps with Application to Genetic Distance

A new version of the paper using entropy-based Principal Components maps for genetic distance (vs Gaussin correlation-based methods). Applied to the PCA of the entire world population, relative distances are markedly different!

Link to the paper – https://arxiv.org/pdf/2303.12654.pdf

[Twitter] Nassim Taleb’s interview with Tucker Carlson when Skin in the Game came out

with Tucker Carlson when Skin in the Game (SITG) came out: Imagine fewer bureaucrats with no SITG, no CIA, a noninterventionist State Dept… In SITG I said that sending State Dept employees to the beach would be better for America & much better for the world.

YouTube video of the interview

You can get the book (Skin in the Game: Hidden Asymmetries in Daily Life) here: Paperback or Hardcover

[Twitter] A mini tutorial explaining the #FooledbyRandomness point

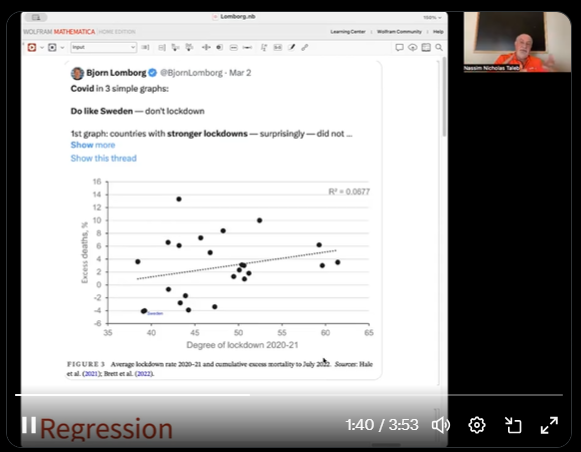

Mistakes often made in the interpretation of R^2 beyond the standard textbook by people who haven’t studied the ‘Fooled by Randomness’ effect on parameters of distribution, particularly when samples are small.

Nassim Taleb announces #RWRI (Real World Risk Workshop) 2024

Workshop organized by the Real World Risk Institute. The workshop is an intense 10-day online program, and the 19th edition will take place from Jun 25- Jul 5, 2024.