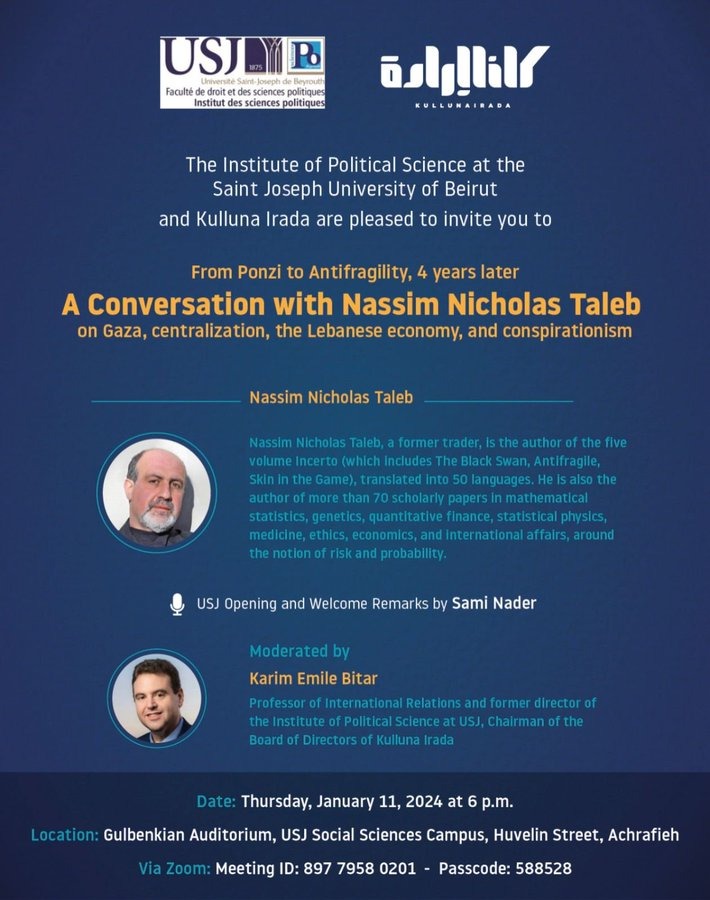

Event Invitation: A Conversation with Nassim Nicholas Taleb

Hosted by: The Institute of Political Science at the Saint Joseph University of Beirut and Kulluna Irada

Event Title: From Ponzi to Antifragility, 4 Years Later

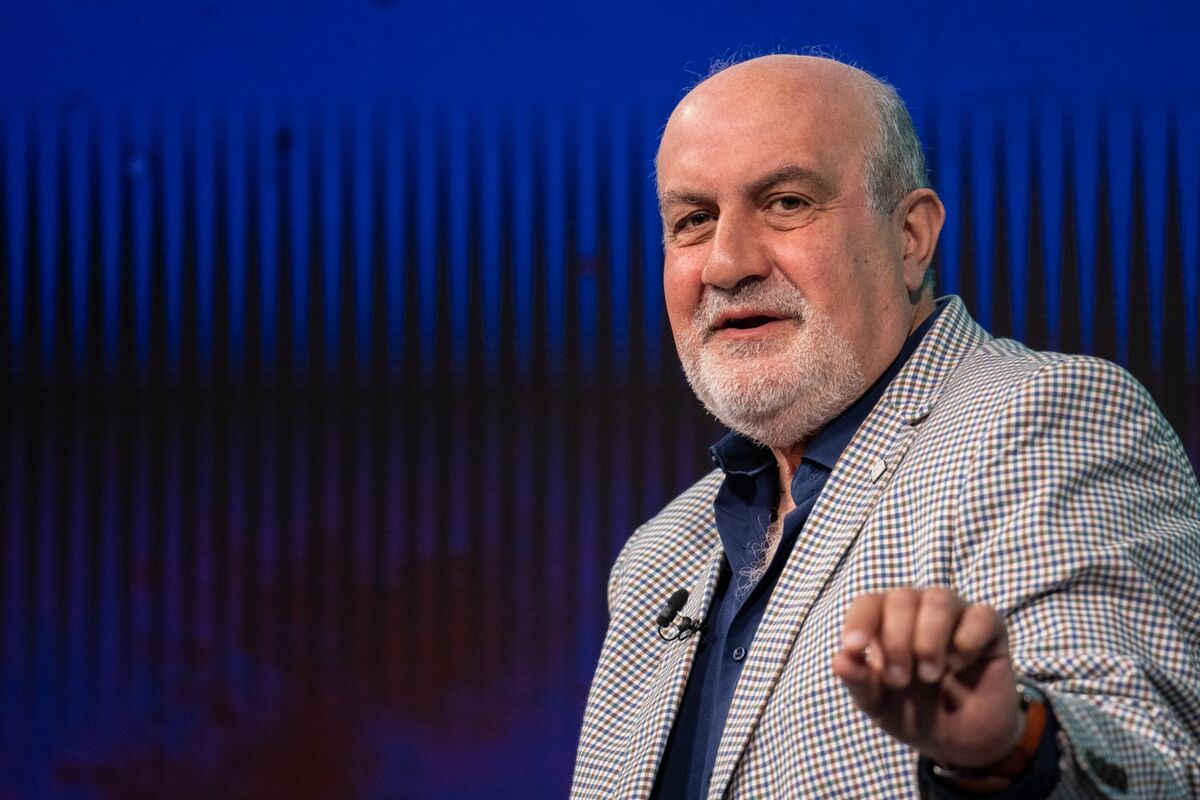

Featuring: Nassim Nicholas Taleb

Topics: Gaza, Centralization, the Lebanese Economy, and Conspirationism

Moderator: Karim Emile Bitar

Date and Time: Thursday, January 11, 2024, at 6 PM

Location: Gulbenkian Auditorium, USJ Social Sciences Campus, Huvelin Street, Achrafieh

Virtual Attendance via Zoom:

- Meeting ID: 897 7958 0201

- Passcode: 588528

Join us for an insightful evening with Nassim Nicholas Taleb, discussing critical contemporary issues in a conversation moderated by Karim Emile Bitar.