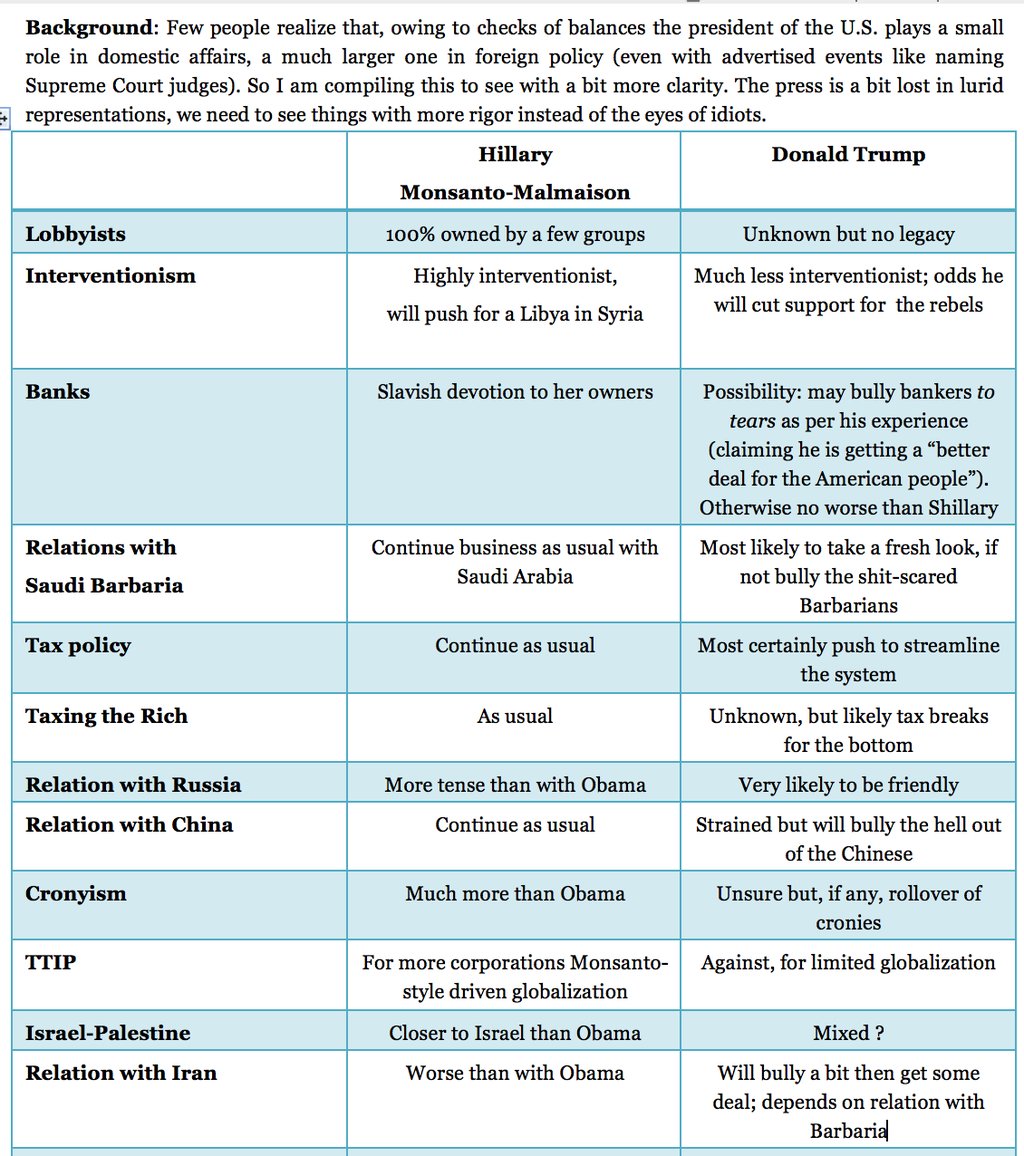

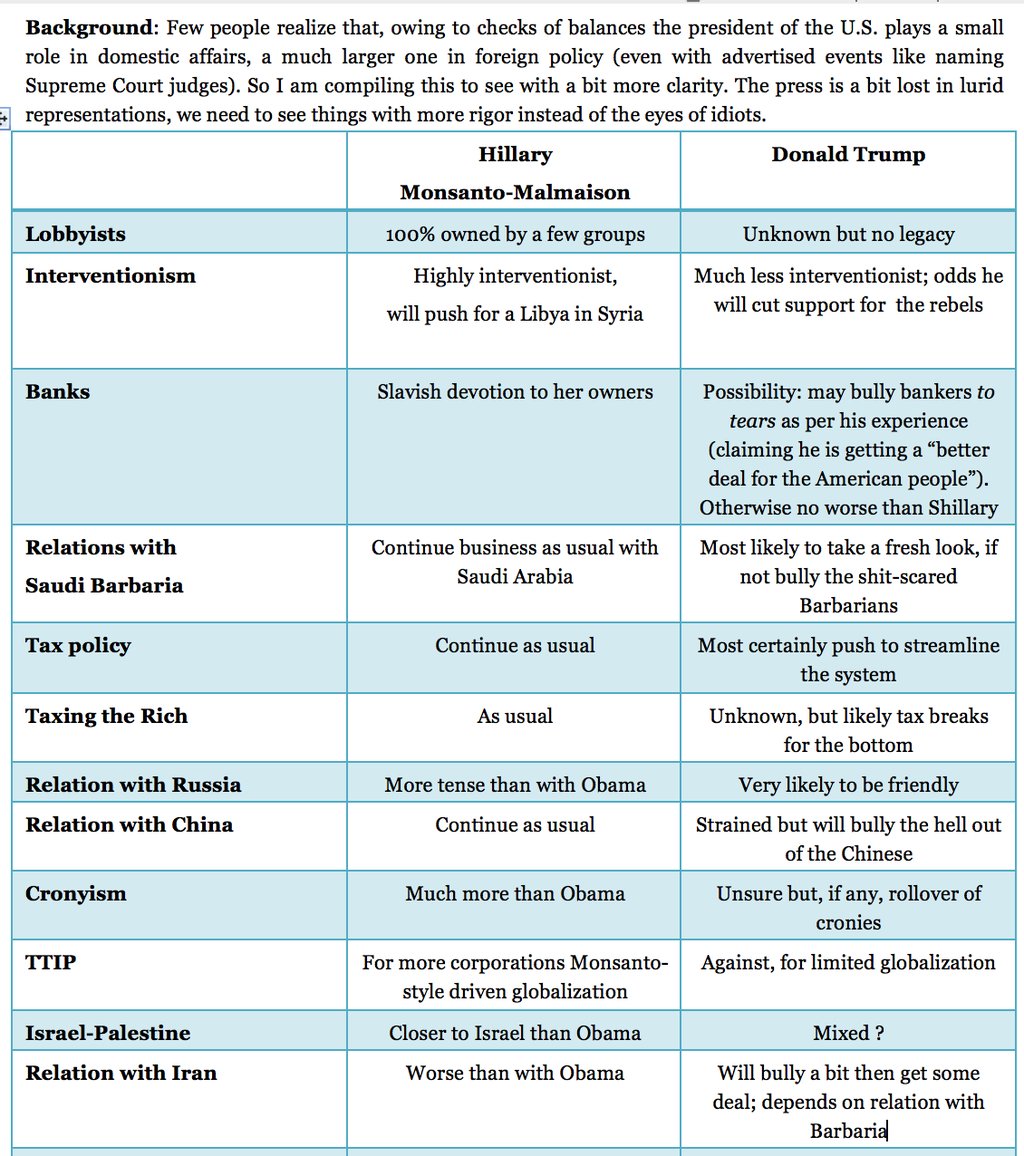

Recently on twitter, Nassim shared this chart comparing outcomes with Clinton as president versus Trump. In response to a question about Sanders versus Trump, he tweeted: “Bernie v. Trump I go Bernie because his domestic policies won’t go through and his foreign policies are clearer.”

He also followed up with these tweets: “Hillary and Bush have done the most to harm minority populations in the Levant & Iraq since Genghis Khan.” “2/What I mean by rigorous is not making assumptions/ certainties when there is uncertainty. Shillary offers certainties, Trump fewer ones.”

He also followed up with these tweets: “Hillary and Bush have done the most to harm minority populations in the Levant & Iraq since Genghis Khan.” “2/What I mean by rigorous is not making assumptions/ certainties when there is uncertainty. Shillary offers certainties, Trump fewer ones.”

He also followed up with these tweets: “Hillary and Bush have done the most to harm minority populations in the Levant & Iraq since Genghis Khan.” “2/What I mean by rigorous is not making assumptions/ certainties when there is uncertainty. Shillary offers certainties, Trump fewer ones.”

He also followed up with these tweets: “Hillary and Bush have done the most to harm minority populations in the Levant & Iraq since Genghis Khan.” “2/What I mean by rigorous is not making assumptions/ certainties when there is uncertainty. Shillary offers certainties, Trump fewer ones.”