Tag: Fat Tails

[YouTube] Why Correlation is Unreliable

At the 2022 Greenwich Economic Forum-Miami, Black Swan author, Nassim Nicholas Taleb explains why correlation is unreliable as a due diligence tool. Coming as it does during an ongoing pandemic and in the middle of Vladimir Putin’s invasion of Ukraine, Taleb also discusses Wars and Pandemics and puts them into their proper risk buckets.

[YouTube] Claims that Violence Has Dropped Are Not Statistical

Violence is from Extremistan, hence requires some more sophisticated tools since LLN works slowly. We see how Pinker’s thesis is bogus. We look at ways to integrate the factual unreliability of historical accounts. We look at transformations to analyze violence using Power law tools since the worst case is bounded at the contemporary population level.

Links to Papers with Pasquale Cirillo

On the statistical properties and tail risk of violent conflicts [TECHNICAL, PHYSICA A]

The Decline of Violent Conflicts: What Do the Data Really Say? [NONTECHNICAL, NOBEL FOUNDATION]

[YouTube] A Conversation between Nassim Nicholas Taleb and Stephen Wolfram at the Wolfram Summer School 2021

Stephen Wolfram plays the role of Salonnière in this new, ongoing series of intellectual explorations with special guests.

[YouTube] Power Laws (maximally simplified)

Power laws, extremely simplified.

[YouTube] P-Value Hacking

We saw that 1) many metrics are stochastic, 2) what is stochastic can be hacked. This is the simplification of my work showing that “p-values are not p-values”, i.e. highly sample dependent, with a skewed distribution. For instance, for a “true” P value of .11, 53% of observations will show less than .05. This allows for hacking: in a few trials, a researcher can get a fake p-value of .01.

Paper is here and in Chapter 19 of SCOFT (Statistical Conseq of Fat Tails): Link to paper – A Short Note on P-Value Hacking

[YouTube] The Law of Large Numbers – a very Intuitive Introduction

Everything in empirical science is based on the law of large numbers. Remember that it fails under fat tails.

[YouTube] Fat Tails: An Introductory Presentation

What are Fat Tails? This is very introductory. See the whole book (gets technical beyond Chapter 5)

Link to the Book: Statistical Consequences of Fat Tails: Real World Preasymptotics, Epistemology, and Applications

[YouTube] Ellipticality and Portfolios: Informal conversation with Raphael Douady (in French)

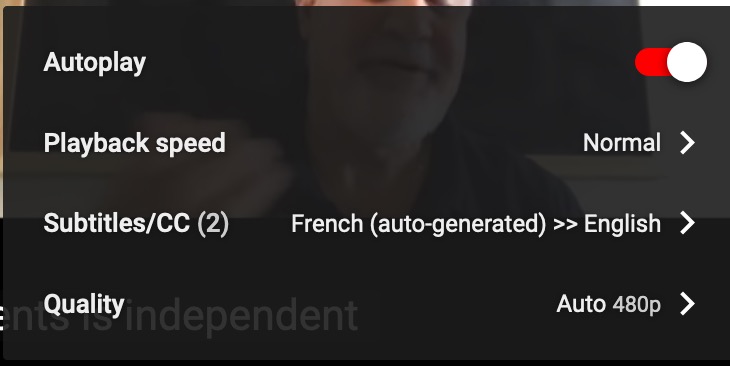

You can get English subtitles by:

Step 1. Click on Settings (gear icon), Subtitles/CC and select French (auto-generated).

Step 2. Go to Settings again, Subtitles/CC and then select Auto-translate and then select English.

It should then show as “Subtitles/CC (2) French (auto-generated) >> English“

[YouTube] Ellipticality (Technical)

Modern financial theory assumes that distributions are elliptical. We show what happens if the assumption doesn’t hold. And the assumption doesn’t hold.

Diversification does NOT reduce risks in the financial market; it causes near-certain long term blowups under any leverage.