[facebookpost https://www.facebook.com/permalink.php?story_fbid=10152457646878375&id=13012333374]

Nassim Posts Document on Skepticism and How Uncertainty Should Actually Lead to More Conservationism

Nassim recently posted a document called “Skepticism” on Facebook.

He had this to say about it:

Something people don’t get: more skepticism about climate models should lead to more “green” ecological conservationist policies not more lax pro-pollution ones. Why? Simply, uncertainty about the models increases fragility (and thickens the left tail), no matter what the benefits can be in the right tail.

Added the section to the precautionary principle. Please discuss but stick to rigor and avoid buzzwords. (Also do not think that the idea is falling from the sky: it is a mere application of the fragility theorems).

Taleb Addresses the N=1 Fallacy

https://www.youtube.com/watch?v=92uG9R6LzuY

Taleb discusses the N=1 Fallacy as part of a series of talks honoring Seth Roberts.

Taleb Co-Founder and Co-Director of EXTREME RISK INITIATIVE

Nassim Taleb is starting the new academic year with a new role. Along with Charles Tapiero, Taleb will be co-director of the EXTREME RISK INITIATIVE, which is expected to develop into an Extreme Risk Institute within the NYU School of Engineering. Here is the official description from his Facebook Page:

In spite of the importance of extreme/hidden risks, there has not been a rigorous methodology to deal with them; statistical or mathematical approaches have not been formally reconciled with real-world decision-making the way engineering has traditionally integrated mathematics and real world heuristics. Extreme risks require both more mathematical and more practical rigor.

The “Extreme Risks Initiative”, ERI, is an NYU-School of Engineering interdisciplinary open research agenda, based on research axes defined by its members and a global research collaborations. Its approaches are at the intersection of the technical and the practical, based on a rigorous merger of theory and practice across interdisciplinary lines. These may include financial and economic engineering, urban risk engineering, transportation-networks, bio-systems, as well as global and environmental problems. A selected series of research axes as well as publications drawing on members’ Initiatives are included in the ERI a working paper series as well as current research enterprises.

Precautionary Principle Paper

Nassim has completed his paper The Precautionary Principle: Fragility and Black Swans from Policy Actions with Yaneer Bar-Yam, Raphael Douady, Joseph Norman, & Rupert Read.

Link to the announcement on his Facebook Page here.

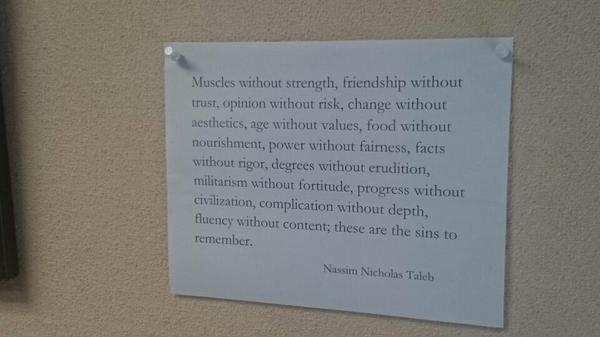

Taleb’s “Sins to Remember”

Nassim Taleb recently tweeted this photo of an index card that outlines “sins to remember.” And presumably avoid.

Risk Neutral Option Pricing Without Dynamic Hedging, A Measure-Theoretic Proof

[facebookpost https://www.facebook.com/permalink.php?story_fbid=10152111753388375&id=13012333374]

Abstract: Proof that under constraints of Put-Call Parity, the probability measure for the valuation of a European option is risk neutral under any general probability distribution, bypassing the Black-Scholes-Merton dynamic hedging argument, and without the requirement of complete markets. The heuristics used by traders for centuries are both more robust and more rigorous than held in the economics literature.

Nassim Taleb keynote at DLD14: How Things Handle Disorder

DLD (Digital-Life-Design) keynote by Nassim Nicholas Taleb.

Nassim Taleb interview with John Dawson on Bloomberg TV’s First Up for Barclays Asia Forum in Hong Kong

Nov. 14 (Bloomberg) — Nassim Nicholas Taleb, a professor at New York University and author of “The Black Swan” and “Antifragile: Things That Gain From Disorder,” talks about risks created by government debt and Federal Reserve monetary policy. He speaks with John Dawson on Bloomberg Television’s “First Up” on the sidelines of Barclays Asia Forum in Hong Kong. (Source: Bloomberg)