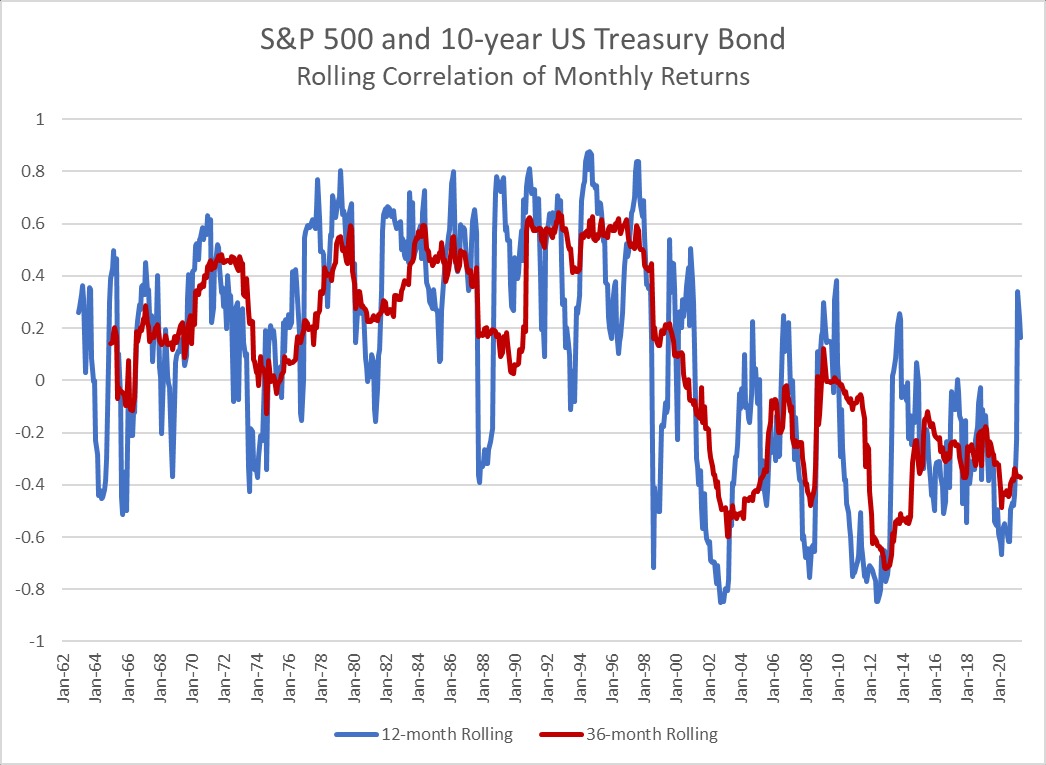

Financial theory requires correlation to be constant (or, at least, known and nonrandom). Nonrandom means predictable with waning sampling error over the period concerned. Ellipticality is a condition more necessary than thin tails, recall my Twitter fight with that non-probabilist Clifford Asness where I questioned not just his empirical claims and his real-life record, but his own theoretical rigor and the use by that idiot Antti Ilmanen of cartoon models to prove a point about tail hedging. Their entire business reposes on that ghost model of correlation-diversification from modern portfolio theory. The fight was interesting sociologically, but not technically. What is interesting technically is the thingy below.

Link to full article – https://fooledbyrandomness.com/blog/2021/11/24/detecting-bs-in-correlation-windows/