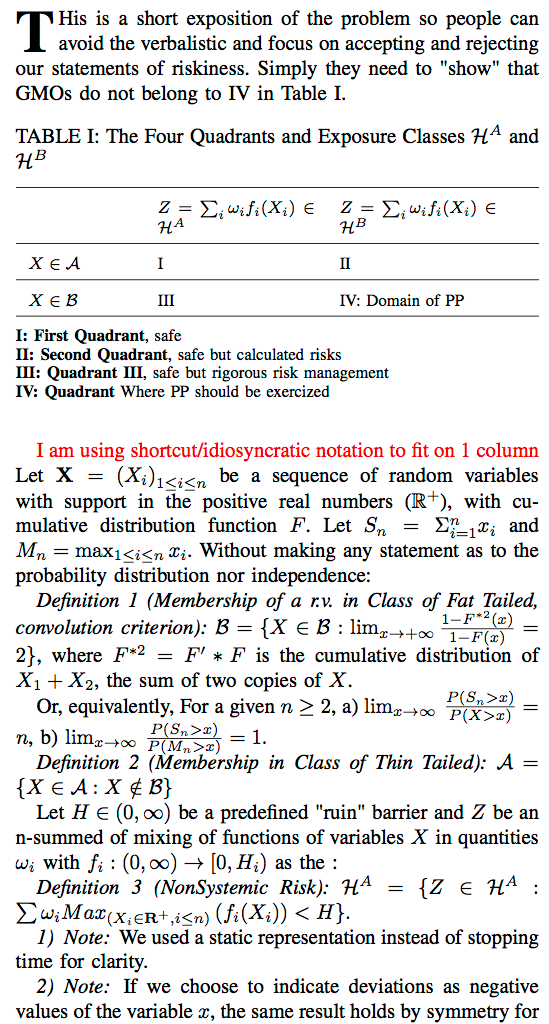

On GMOs: “A pound of algebra is worth a ton of verbal commentary”. I managed to fit the Precautionary Principle into a few lines. The GMO paid propagandists are pounding tons of verbalistic statements (even an incompetent smear campaign), but this simple summary should cancel about everything they are trying to say. In a single column. They need to refute my representation or show that f(breeding) has the same maximum as f(GMOs).