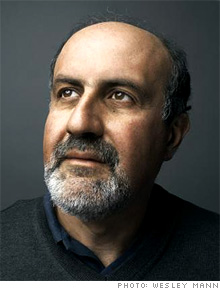

Nassim has just posted on his Facebook Page a 3-page PDF titled: Why It is No Longer a Good Idea to Be in The Investment Industry.

A spurious tail is the performance of a certain number of operators that is entirely caused by luck, what is called the “lucky fool” in Taleb (2001). Because of winner-take-all-effects (from globalization), spurious performance increases with time and explodes under fat tails in alarming proportions. An operator starting today, no matter his skill level, and ability to predict prices, will be outcompeted by the spurious tail. This paper shows the effect of powerlaw distributions on such spurious tail.

Unique Coverage/Mentions Around the Web:

The Wall Street Journal (MarketBeat Blog): Nassim Taleb: Stay Out of the Investment Industry

TIME.com (Investing): Nassim Taleb: In the Investment Biz, Luck Trumps Skill, So Take Your Talent Elsewhere

CNBC: Nassim Taleb: Stay Out of Finance!

Business Insider: NASSIM TALEB WARNS: Stay Out Of The Investment Industry.

Streetcoup: Nassim Taleb: Aspiring Money Managers Will Fail

reddit: “Black Swan” Author Nassim Taleb: Stay Out of the Investment Industry

Mindful Money: Nassim Taleb – Why you should avoid the investment industry

Nassim Taleb on Twitter (@nntaleb):

WSJ TOTALLY misreprsntd: my paper NOT abt “lucky fool” (old) but about the effect of fat tails and globalization; only @felixsalmon got it

Felix Salmon: The secret to success in the arts