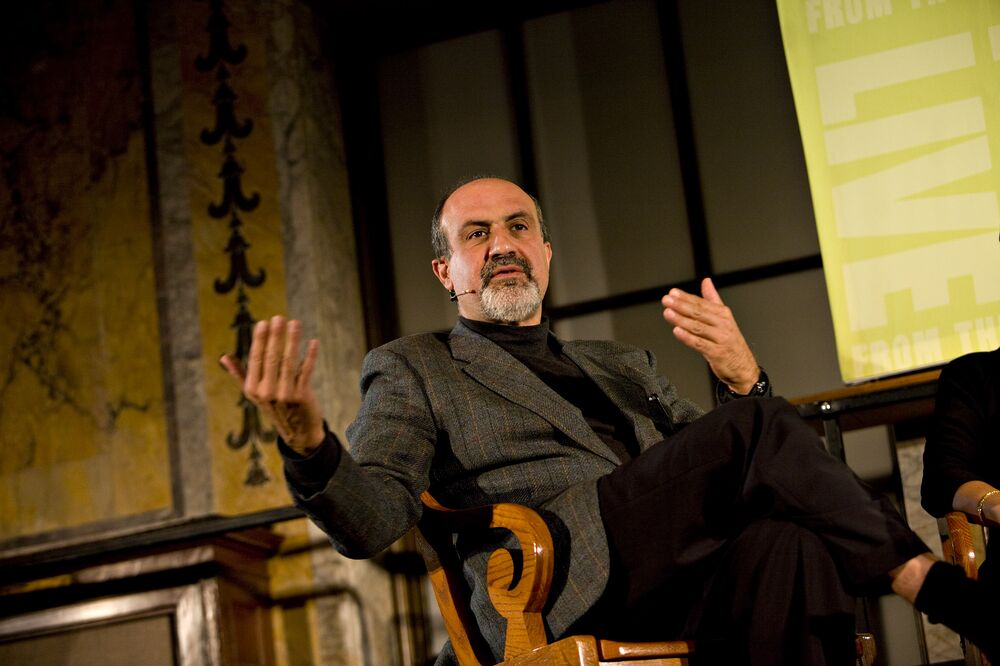

Universa Investments Senior Scientific Advisor Nassim Taleb says the stock market is way too overvalued given current interest rates, and the road back to normal will be “very painful for some.” Taleb spoke exclusively to Bloomberg’s Sonali Basak at an investor day in Miami on Thursday. Earlier, Universa Investments told clients that ballooning debts across the global economy are poised to wreak havoc on markets rivaling the Great Depression.

Tag: Bloomberg

[YouTube] COVID Misconceptions, Fed Policy, Inflation

Nassim Taleb, New York University distinguished professor of risk engineering, discusses what he sees as misconceptions about the coronavirus pandemic and comments on the Federal Reserve’s shift in monetary policy. He speaks with Bloomberg’s Erik Schatzker.

Bloomberg: Black Swan Author Spars With Quant Legend Over Tail Risk Hedges

“Black Swan” author Nassim Nicholas Taleb and quant investing pioneer Cliff Asness have engaged in a vitriolic Twitter dispute over the esoteric world of tail-risk hedging that descended into personal insults.

The spat began when Taleb sent a pair of tweets accusing the $143 billion AQR Capital Management LLC of issuing flawed reports that say tail-risk hedging doesn’t work.

Link to Bloomberg article: Black Swan Author Spars With Quant Legend Over Tail Risk Hedges

Bloomberg: Nassim Says World Is More Fragile Today Than in 2007

Black Swan Man made an appearance in my interview today with Nassim Taleb. Watch it here: https://t.co/IntplCaKHO pic.twitter.com/ksTLcEwh8U

— Erik Schatzker (@ErikSchatzker) October 31, 2018

Nassim Nicholas Taleb, scientific advisor at Universa Investments, discusses the factors causing global fragility, hidden liabilities in global markets, and what he sees as safe trades in the current market. He speaks with Bloomberg’s Erik Schatzker on “Bloomberg Markets.” (Source: Bloomberg)

Link: https://www. bloomberg .com/ news/ videos/ 2018-10-31/ taleb-says-world-is…

Nassim Taleb on Bloomberg: Black Monday, Fed, Market Lessons

Oct.16 — The Black Monday crash was 30 years ago this week. “Black Swan” author Nassim Taleb was a trader for First Boston at the time. He made a lot of money while others lost fortunes. He recounts the experience with Bloomberg’s Erik Schatzker.

Also see written article here: The Crash of ’87, From the Wall Street Players Who Lived It

Bloomberg: Nassim Nicholas Taleb Sees Greater Risks Than Nuclear War

Aug.16 — Nassim Nicholas Taleb, adviser at Universa Investments, sat down for an interview with Erik Schatzker Tuesday evening in New York. Taleb, famous for his assessment of risk, says there are greater risks out there than nuclear war with North Korea.

Nassim Speaks to Bloomberg News

Nassim spoke to Bloomberg News while he was at the SALT Conference in Last Vegas from May 10th to the 13th. Bloomberg has put up four short videos with him on their website, which we share below.

The Importance of Probability:

Comparing Monetary Policy to Drugs:

Nassim Taleb interview with John Dawson on Bloomberg TV’s First Up for Barclays Asia Forum in Hong Kong

Nov. 14 (Bloomberg) — Nassim Nicholas Taleb, a professor at New York University and author of “The Black Swan” and “Antifragile: Things That Gain From Disorder,” talks about risks created by government debt and Federal Reserve monetary policy. He speaks with John Dawson on Bloomberg Television’s “First Up” on the sidelines of Barclays Asia Forum in Hong Kong. (Source: Bloomberg)

[VIDEO] Nassim Taleb on Bloomberg’s Inside Track talks about Quantitative Easing II

In November of 2012, immediately after U.S. Federal Reserve Bank Chairman, Ben Bernanke announced the implementation of Quantitative Easing II, Nassim Taleb contacted Bloomberg News interviewer, Erik Schatzker to say “Something has to be done about Ben Bernanke”.