In this video, Nassim provides a general presentation of his research, in which he debunks Pinker’s faulty statistics in his book on violence (The Better Angels of Our Nature: Why Violence Has Declined).

Found on Nassim’s facebook page.

.org (UNOFFICIAL news site)

In this video, Nassim provides a general presentation of his research, in which he debunks Pinker’s faulty statistics in his book on violence (The Better Angels of Our Nature: Why Violence Has Declined).

Found on Nassim’s facebook page.

FightMediocrity on the notion of antifragility in this animated short.

The following article by Mark Buchanan was recently published on Medium. It discusses recent analysis by Nassim, along with Pasquale Cirillo, of historical warfare statistics. This analysis contradicts the popular idea that future violent wars are unlikely:

Violent warfare is on the wane, right?

Many optimists think so. But a close look at the statistics suggests that the idea just doesn’t add up.

A spate of recent and not so recent books have suggested that “everything is getting better,” that the world is getting more peaceful, more civilized, and less violent. Some of these claims stand up. In his book The Better Angels of Our Nature, psychologist Steven Pinker made the case that everything from slavery and torture to violent personal crime and cruelty to animals has decreased in modern times. He presented masses of evidence. Such trends, it would certainly seem, are highly unlikely to be reversed.

Pinker also suggested — as have others, including historian Niall Ferguson — that something big has changed about violent warfare since 1945 as well. Here too, the world seems to have become much more peaceful, as if war is becoming a thing of the past. As he wrote,

… wars between great powers and developed nations have fallen to historically unprecedented levels. This empirical fact has been repeatedly noted with astonishment by many military historians and international relations scholars…

Pinker admits that this might be a statistical illusion; perhaps we’ve just experienced a recent lull, and war will resume with its full historical fury sometime soon. But he thinks this is unlikely, for a variety of reasons. These include…

the fact that the drop in the frequency of wars among great powers and developed states has been so sudden and massive (essentially, to zero) as to suggest a qualitative change; that territorial conquest has similarly all but vanished in the planning and outcomes of wars; that the period without major war has also seen sharp reductions in conscription, length of military service, and per-GDP military expenditures; that it has seen declines in every exogenous variable that are statistically predictive of militarized disputes; and that war rhetoric and war planning have disappeared as live options in the political deliberations of developed states in their dealings with one another. None of these observations were post-hoc, offered at the end of a fortuitously long run that was spuriously deemed improbable in retrospect; many were made more than three decades ago, and their prospective assessments have been strengthened by the passage of time.

Again, Pinker has gone to lengths to emphasize that none of this proves anything abut future wars. But it is strongly suggestive, he believes, that this is significant evidence for such a belief.

Nassim Taleb criticized Pinker’s arguments a few years ago, arguing that Pinker didn’t take proper account of the statistical nature of war as a historical phenomenon, specifically as a time series of events characterized by fat tails. Such processes naturally have long periods of quiescence, which get ripped apart by tumultuous upheavals, and they lure the mind into mistaken interpretations. Pinker responded, clarifying his view, and the quotes above come from that response . Pinker acknowledged the logical possibility of Taleb’s view, but suggested that Taleb had “no evidence that is true, or even plausible.”

That has now changed. Just today, Taleb, writing with another mathematician, Pasquale Cirillo, has released a detailed analysis of the statistics of violent warfare going back some 2000 years, with an emphasis on the properties of the tails of the distribution — the likelihood of the most extreme events. I’ve written a short Bloomberg piece on the new paper, and wanted to offer a few more technical details here. The analysis, I think, goes a long way to making clear why we are so ill-prepared to think clearly about processes governed by fat tails, and so prone to falling into interpretive error. Moreover, it strongly suggests that hopes of a future with significantly less war are NOT supported by anything in the recent trend of conflict infrequency. The optimists are fooling themselves.

Anyone can read the paper, so I’ll limit myself to simply summarizing a few of the main points:

There are quite few other gems in the analysis, but these seem to me to be the most important.

One final thing, and maybe this is most important. Cirillo and Taleb make a strong argument that the quantity that one should study and try to estimate from the statistics is the tail exponent α (see point 5 above). This is certainly not easy to estimate, and it takes a lot of data to get even a crude estimate, but working with α is a much better way of getting at the true mean of the process than working with the sample mean over various periods. Looking at past events, and estimating the average number over any period, is simply a bad way to go about thinking about any process of this kind. The sample mean is NOT a mathematically sound estimate of the true mean of the process. For more on this, see Taleb’s comments at the top of the 3rd page of his earlier criticism of Pinker’s argument.

And that, I think, is pretty good reason to believe that all talk of the dwindling likelihood of wars based on recent past experience is mostly based on illusion and people telling themselves convincing but probably unfounded stories. Sure it looks as if things are getting more peaceful. But, looking at the mathematics, that’s exactly what we should expect to see, even if we’re most likely due for a much more violent future.

As the keynote speaker for the 2015 Fletcher Political Risk Conference, Nassim spoke about Fat Tails.

Nassim joins psychologist Daniel Kahneman and journalist Gillian Tett in discussing intuition and instincts and their consequences in decision-making.

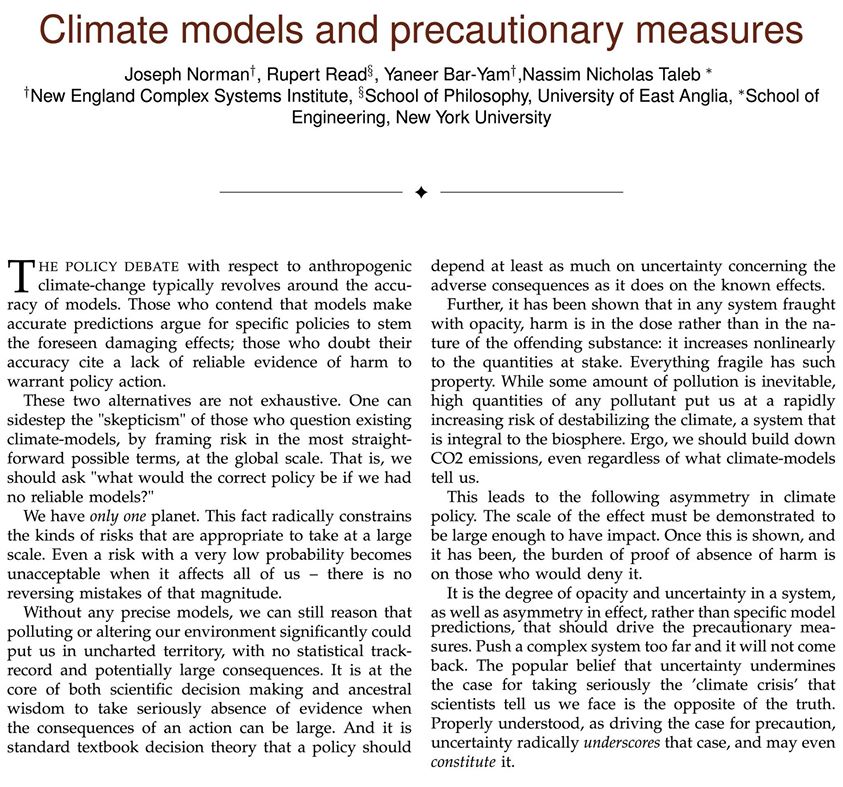

Nassim’s statement on climate models, along with Joseph Norman, Rupert Read, and Yaneer Bar-Yam. He says, “We have *only one* planet and need to learn to live with imperfection of models.”

Posted on Nassim’s facebook page.

This is an audio recording of Nassim speaking at the Stanford Technology Ventures Program’s Entrepreneurial Thought Leaders series. It’s called How Things Gain From Disorder.

Thanks to QuantLabs.net for the link.

For the Poker Asia Pacific website, Australian poker player Daniel Laidlaw discusses Nassim’s books and how they reframed his thinking about poker.

On twitter, Nassim refers to a “mistake” he made “about power laws with ‘near-infinite’ but not infinite support.” He explains in this document: