Nassim shares Chapter 1 of his work-in-progress, Silent Risk, which explains what the Black Swan problem is and is not. He comments that it is “still incomplete, but useful.”

From his Facebook Page.

.org (UNOFFICIAL news site)

Nassim shares Chapter 1 of his work-in-progress, Silent Risk, which explains what the Black Swan problem is and is not. He comments that it is “still incomplete, but useful.”

From his Facebook Page.

Nassim shares his latest monograph (co-authored by Raphael Douady) and introduces his new venture in publishing at the same time:

Descartes Monographs accept only manuscripts that have been rigorously peer-

reviewed or contain material that has appeared in peer-reviewed journals or has

been sufficiently cited to merit inclusion in the series. Its aim is to “Überize”

academic publishing by cutting the middleperson and producing books of the

highest scientific quality at the most affordable price. Descartes engages in ethical

publishing, avoiding double-charging the public sector for books produced on

university time.

From his Facebook Page.

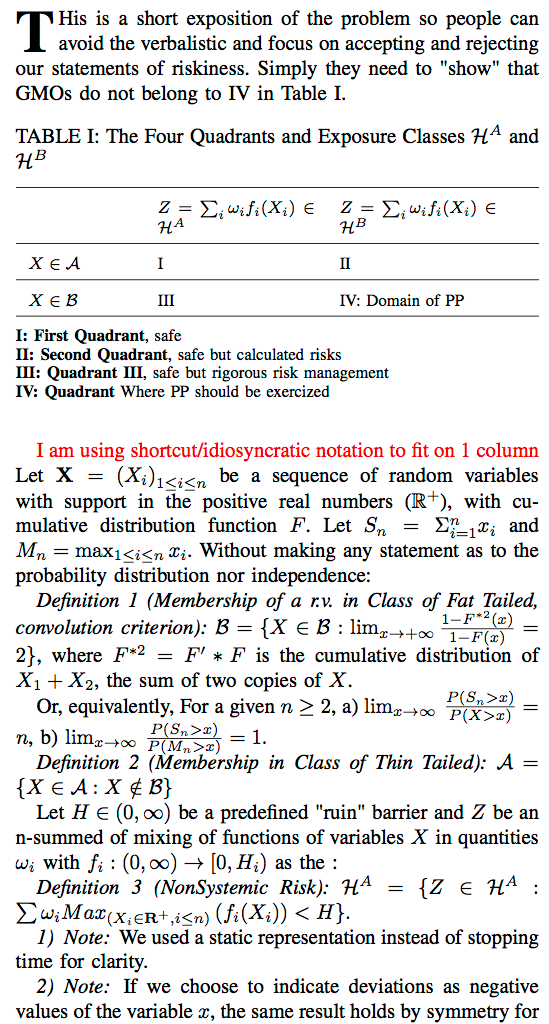

On GMOs: “A pound of algebra is worth a ton of verbal commentary”. I managed to fit the Precautionary Principle into a few lines. The GMO paid propagandists are pounding tons of verbalistic statements (even an incompetent smear campaign), but this simple summary should cancel about everything they are trying to say. In a single column. They need to refute my representation or show that f(breeding) has the same maximum as f(GMOs).

Nassim recently posted a document called “Skepticism” on Facebook.

He had this to say about it:

Something people don’t get: more skepticism about climate models should lead to more “green” ecological conservationist policies not more lax pro-pollution ones. Why? Simply, uncertainty about the models increases fragility (and thickens the left tail), no matter what the benefits can be in the right tail.

Added the section to the precautionary principle. Please discuss but stick to rigor and avoid buzzwords. (Also do not think that the idea is falling from the sky: it is a mere application of the fragility theorems).

Nassim Taleb is starting the new academic year with a new role. Along with Charles Tapiero, Taleb will be co-director of the EXTREME RISK INITIATIVE, which is expected to develop into an Extreme Risk Institute within the NYU School of Engineering. Here is the official description from his Facebook Page:

In spite of the importance of extreme/hidden risks, there has not been a rigorous methodology to deal with them; statistical or mathematical approaches have not been formally reconciled with real-world decision-making the way engineering has traditionally integrated mathematics and real world heuristics. Extreme risks require both more mathematical and more practical rigor.

The “Extreme Risks Initiative”, ERI, is an NYU-School of Engineering interdisciplinary open research agenda, based on research axes defined by its members and a global research collaborations. Its approaches are at the intersection of the technical and the practical, based on a rigorous merger of theory and practice across interdisciplinary lines. These may include financial and economic engineering, urban risk engineering, transportation-networks, bio-systems, as well as global and environmental problems. A selected series of research axes as well as publications drawing on members’ Initiatives are included in the ERI a working paper series as well as current research enterprises.

Nassim has completed his paper The Precautionary Principle: Fragility and Black Swans from Policy Actions with Yaneer Bar-Yam, Raphael Douady, Joseph Norman, & Rupert Read.

Link to the announcement on his Facebook Page here.

[facebookpost https://www.facebook.com/permalink.php?story_fbid=10152111753388375&id=13012333374]

Abstract: Proof that under constraints of Put-Call Parity, the probability measure for the valuation of a European option is risk neutral under any general probability distribution, bypassing the Black-Scholes-Merton dynamic hedging argument, and without the requirement of complete markets. The heuristics used by traders for centuries are both more robust and more rigorous than held in the economics literature.

Constantine Sandis

Oxford Brooks

Nassim Nicholas Taleb

NYU-Poly; Université Paris I Panthéon-Sorbonne – Centre d’Economie de la Sorbonne (CES)

July 30, 2013

Abstract:

Standard economic theory makes an allowance for the agency problem, but not the compounding of moral hazard in the presence of informational opacity, particularly in what concerns high-impact events in fat tailed domains. But the ancients did; so did many aspects of moral philosophy. We propose a global and morally mandatory heuristic that anyone involved in an action which can possibly generate harm for others, even probabilistically, should be required to be exposed to some damage, regardless of context. While perhaps not sufficient, the heuristic is certainly necessary hence mandatory. It is supposed to counter risk hiding and transfer in the tails. We link the rule to various philosophical approaches to ethics and moral luck.

http:// papers. ssrn. com/ sol3/ papers.cfm? abstract_id=2298292

From Nassim Taleb’s Facebook Page:

Life is Randomness! Life is Antifragility!

More evidence that you are alive if & only if you like volatility. More evidence of Jensen’s inequality (convex response). This article passed my filter, my bi-monthly linking allowance. (via Steven Stogatz)

Yang H, Xu-Friedman MA.

Department of Biological Sciences, University at Buffalo, State University of New York, Buffalo, New York 14260.

Release of neurotransmitter is an inherently random process, which could degrade the reliability of postsynaptic spiking, even at relatively large synapses. This is particularly important at auditory synapses, where the rate and precise timing of spikes carry information about sounds. However, the functional consequences of the stochastic properties of release are unknown. We addressed this issue at the mouse endbulb of Held synapse, which is formed by auditory nerve fibers onto bushy cells (BCs) in the anteroventral cochlear nucleus. We used voltage clamp to characterize synaptic variability. Dynamic clamp was used to compare BC spiking with stochastic or deterministic synaptic input. The stochastic component increased the responsiveness of the BC to conductances that were on average subthreshold, thereby increasing the dynamic range of the synapse. This had the benefit that BCs relayed auditory nerve activity even when synapses showed significant depression during rapid activity. However, the precision of spike timing decreased with stochastic conductances, suggesting a trade-off between encoding information in spike timing versus probability. These effects were confirmed in fiber stimulation experiments, indicating that they are physiologically relevant, and that synaptic randomness, dynamic range, and jitter are causally related.